For long-term investors, it’s crucial to concentrate on a company’s future over the next decade and plan investments accordingly. However, spotting growth stocks that have short-term catalysts can also lead to quick gains.

After a downturn earlier this year, Advanced Micro Devices(NASDAQ: AMD) and Amazon(NASDAQ: AMZN) are beginning to see their stock prices rise. AMD is at the forefront of providing artificial intelligence (AI) chips to data centers, while Amazon benefits significantly from the rising use of robotics in its fulfillment operations.

Interested in investing $1,000? Our team of analysts has just disclosed their picks for the 10 top stocks to buy now. Learn More »

Let’s explore what is driving the uptick in these stocks and why they hold potential for further growth.

1. Advanced Micro Devices

AMD shares have surged by 61% since reaching a 52-week low of $76.48 in April. The company has reported its third consecutive quarter of increasing revenue as it gears up to launch updated versions of its MI300 series of graphics processing units (GPUs) tailored for data centers.

AMD is gaining traction through a recent partnership with Saudi Arabia’s new AI initiative HUMAIN to create cost-effective computing systems using AMD chips for significant AI workloads across various sectors. With upcoming launches, such as the MI350 GPU, AMD anticipates boosted performance metrics and has received strong customer interest.

2. Amazon

Amazon shares have rebounded by 42% from their 52-week low of $151.76. Analysts expect record earnings in 2025 and 2026, suggesting that the stock is poised for further gains.

The company experienced a 62% year-over-year increase in earnings in the first quarter, propelled by its heightened use of robotics within its fulfillment network, positioning itself for a strong second-half performance in 2025.

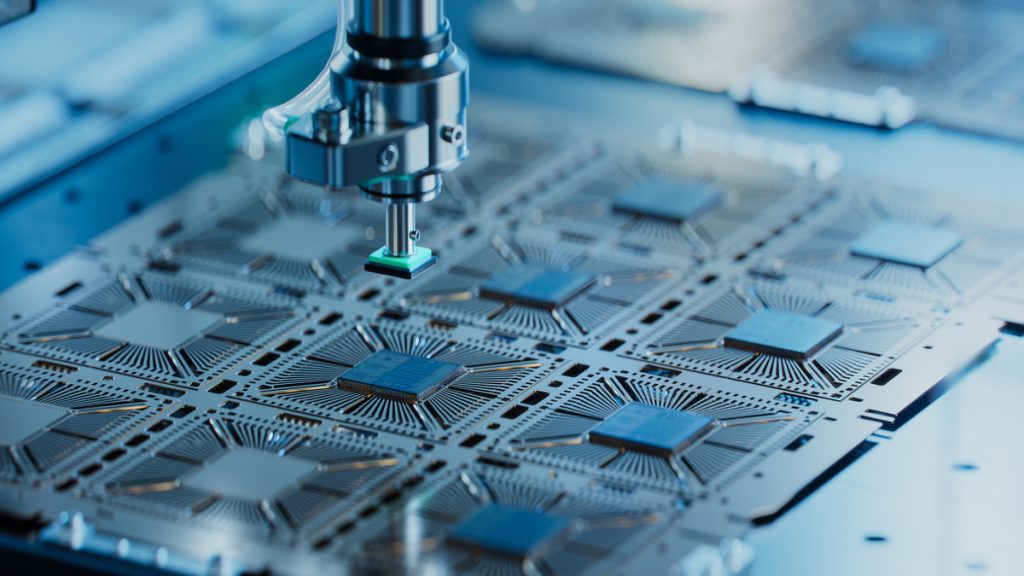

As the largest user of robotics, Amazon has over 750,000 industrial robots improving its operational efficiency. Future advancements in AI and robotics are expected to enhance productivity and profit margins, which are currently not fully captured in the stock’s valuation. Trading at 35 times projected 2025 earnings, the stock appears well-positioned for long-term growth.