Investing in these semiconductor and cloud computing industry leaders could be a smart move.

As demand for chips and cloud services surges due to AI, the AI chip market is projected to grow at an annual rate of 29% until 2030, while the cloud computing sector is expected to see a 20% annual growth rate.

If you’re an investor seeking quality growth stocks in this booming sector, here are two excellent options.

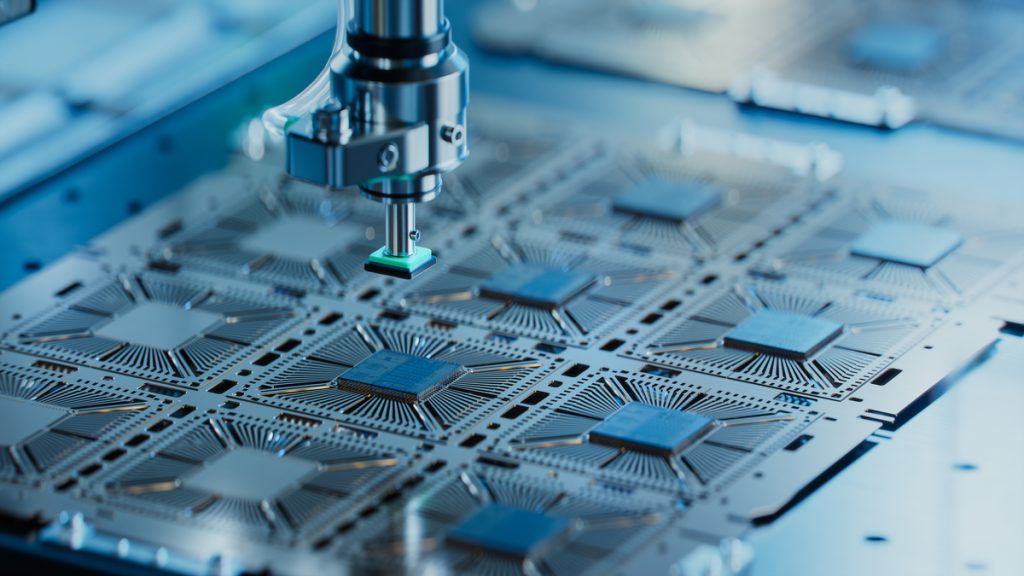

1. Taiwan Semiconductor Manufacturing

The rising need for AI chips is propelling significant growth for Taiwan Semiconductor Manufacturing (TSM 1.50%). Known as TSMC, this leading chipmaker manufactures chips for top designers like Nvidia, Apple, and Advanced Micro Devices, holding a dominant 65% share of the global foundry market, according to Counterpoint Research.

With decades of investment in advanced chipmaking processes, TSMC has developed a solid reputation, allowing clients to concentrate on designing powerful chips. Its longstanding relationships provide a competitive edge; even Intel has struggled to compete with TSMC despite its new investments in foundry capabilities.

Demand for AI and high-performance chips led to a 44% year-over-year revenue increase for TSMC in the second quarter, and its strong market position enables it to maintain a net margin exceeding 42%. As AI developments demand more computational power, TSMC is poised for continued financial success and is expanding its manufacturing capacity in the U.S. to meet this growing demand.

Despite leading the foundry market, the stock appears undervalued with a forward price-to-earnings ratio (P/E) of 28. Analysts predict earnings will grow 21% annually in the coming years, indicating that the stock could double in value within four years if it maintains its current valuation.

2. Oracle

AI is a significant growth driver for the cloud computing sector, enabling businesses to gain deeper insights from their data. Oracle (ORCL -0.89%) stands out as a top pick due to its leadership in enterprise database services and a data center infrastructure designed for AI optimization.

Although Oracle’s total revenue increased by 12% year-over-year last quarter, the true momentum is illustrated by its rapidly growing cloud infrastructure sector, where it secured major contracts with tech giants. In the second quarter, its remaining performance obligations soared 359% year-over-year.

This exceptional growth signals that Oracle is becoming the preferred platform for AI applications in the cloud, allowing it to bundle its premier database services with leading AI models. Furthermore, the company benefits from integrated offerings across various platforms such as Amazon, Google, and Microsoft, leading to an impressive 1,529% surge in multi-cloud revenue last quarter.

Management expects ongoing momentum as more tasks transition from AI training to inferencing. Its cloud infrastructure revenue is anticipated to grow by 77% this year. Increased demand will drive total revenue up by 16% in fiscal 2026 in constant currency, confirming the stock’s elevated P/E multiple and establishing a robust potential for returns for investors.

John Ballard is invested in Advanced Micro Devices and Nvidia. The Motley Fool is invested in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Intel, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.