Recent reports indicate that discussions in the UK Parliament are considering Ripple and XRP as possible national infrastructure. Although Ripple has submitted evidence to UK committees and engaged in dialogues about digital asset policy, claims of “official recognition” are exaggerated.

References or evidence in Parliament are typical aspects of industry engagement and do not constitute formal approval. For XRP to achieve official national infrastructure status, a concrete decision from the UK government or the Bank of England would be required, a scenario that is not currently in sight.

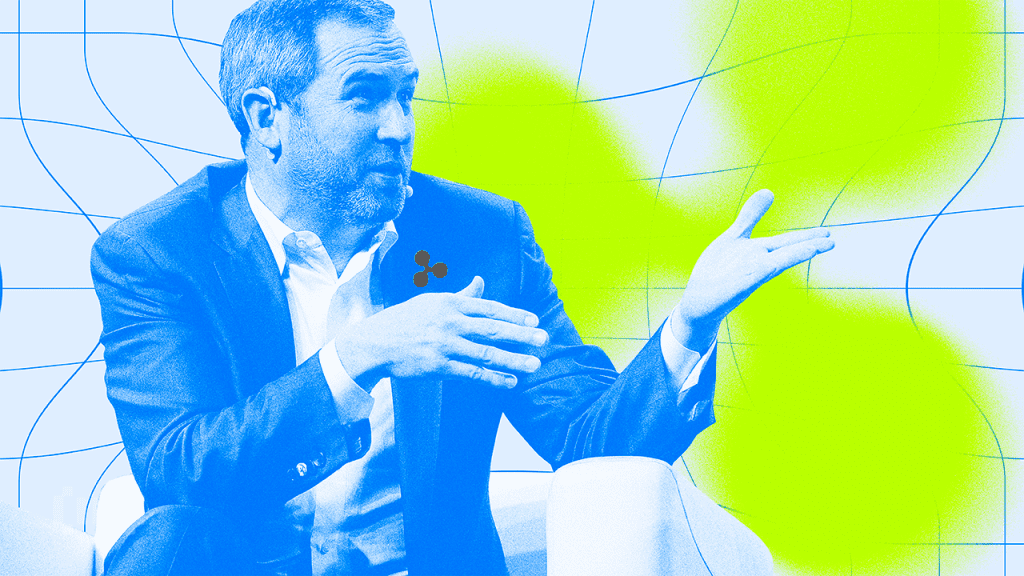

Ripple’s Engagement in UK Policy Discussions

Ripple has been involved in regulatory dialogues in the UK, providing evidence to both the Treasury and DCMS committees. It is also registered with the Financial Conduct Authority for conducting money services operations.

Understanding “Formal Recognition” for XRP

For XRP to gain the status of “national infrastructure,” it must comply with stringent criteria, which include regulatory oversight, risk assessment, and alignment with the Bank of England’s guidelines.

The critical payment systems within the UK, like CHAPS and the Real-Time Gross Settlement (RTGS) system, are centrally managed and regularly audited, making it difficult for a decentralized and volatile cryptocurrency like XRP to fit into that framework.

Tech-Neutrality in UK Policies

The Financial Services and Markets Act 2023 empowers regulators to oversee stablecoins and tokenized payments. The emphasis is placed on the activities rather than specific assets.

The Bank of England and FCA are working on frameworks specifically for fiat-backed stablecoins, steering clear of speculative tokens. This approach reduces the likelihood of the UK singling out XRP for special treatment.

Ripple’s Potential Growth Without XRP’s Endorsement

Ripple is expected to increase its influence in the UK through partnerships and collaborative infrastructure efforts, potentially aiding regulated corridors for remittances or cross-border payments under FCA supervision.

Such an alliance would align with the UK government’s aims for greater efficiency in financial transactions via blockchain. Nonetheless, this does not equate to official endorsement of XRP as a critical national infrastructure.

Challenges to Formal Endorsement

Several factors render official recognition improbable. The UK largely prioritizes regulatory stability and sovereign control over its payment systems. XRP’s inherent volatility, decentralized governance, and historical legal challenges in the U.S. pose potential regulatory risks.

Furthermore, the Bank of England’s development of its digital pound initiative and revamped RTGS system limit any feasibility for integrating external tokens.

Looking Ahead: A Realistic Perspective

A more plausible scenario is Ripple acting as a private infrastructure partner, rather than becoming part of the public financial framework.

The company is likely to influence policy, enhance its service corridors, and provide liquidity in compliance with regulations, without XRP attaining the status of government-sanctioned currency.

In summary, the possibility of the UK Parliament formally endorsing XRP remains extremely low, but Ripple’s collaborative efforts with regulators will continue to play a vital role in shaping the landscape of digital finance.