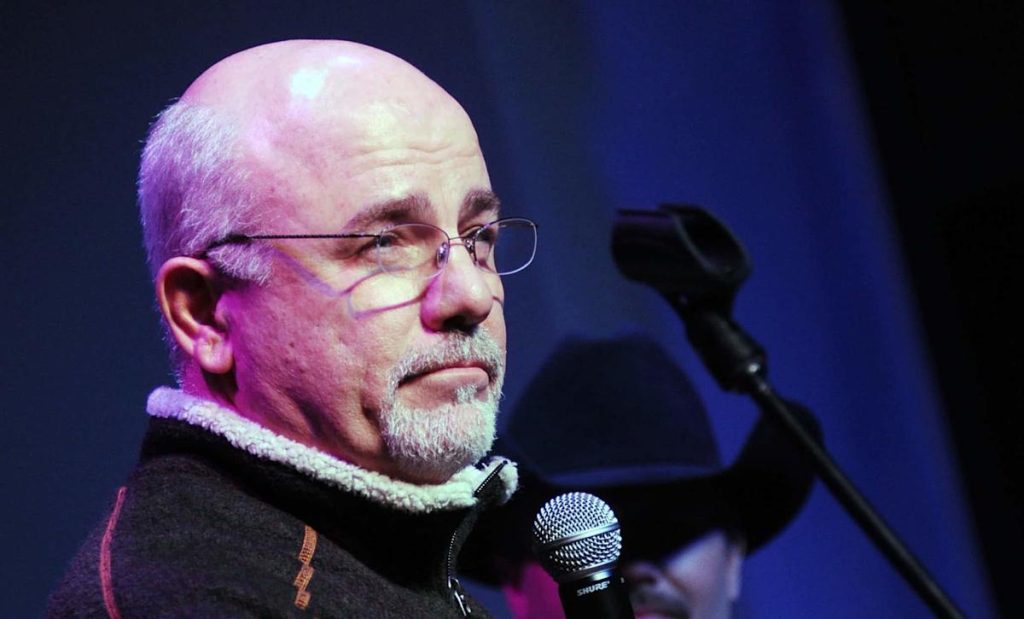

Simple Investment Strategies by Dave Ramsey

Dave Ramsey focuses his investments solely on his business, debt-free real estate, and mutual funds, steering clear of individual stocks and cryptocurrencies like Bitcoin.

Financial expert Peter Lynch successfully grew the Fidelity Magellan fund from $20 million to $14 billion in assets under management with an impressive average annual return of 29% between 1977 and 1990.

Ramsey cites a rancher he knows, who has amassed a fortune of $200 million primarily through smart investments in farmland, exemplifying that successful wealth building often involves focusing on one’s area of expertise.

In a recent episode of “The Ramsey Show,” Ramsey argues that the keys to financial success are not hidden secrets; rather, they stem from common sense and the discipline of investing in familiar territories.

He warns against chasing trendy or “cool” investment opportunities, emphasizing that these distractions can often lead to financial disasters. For instance, Ramsey references the infamous Bernie Madoff Ponzi scheme, which misled many individuals due to its illusion of an exclusive, high-reward strategy.

Ramsey advocates for a straightforward approach to investing, adhering to the KISS principle, which stands for “Keep It Simple, Stupid.” He maintains that many complex financial strategies are unnecessary and instead emphasizes investing in known entities for clarity and security.

Despite differing opinions on stock investments, Ramsey’s philosophy mirrors that of Peter Lynch, who recommended investing in familiar products with thorough research. Both experts agree that true wealth building involves a clear understanding of one’s finances and sticking to a simple investment plan.