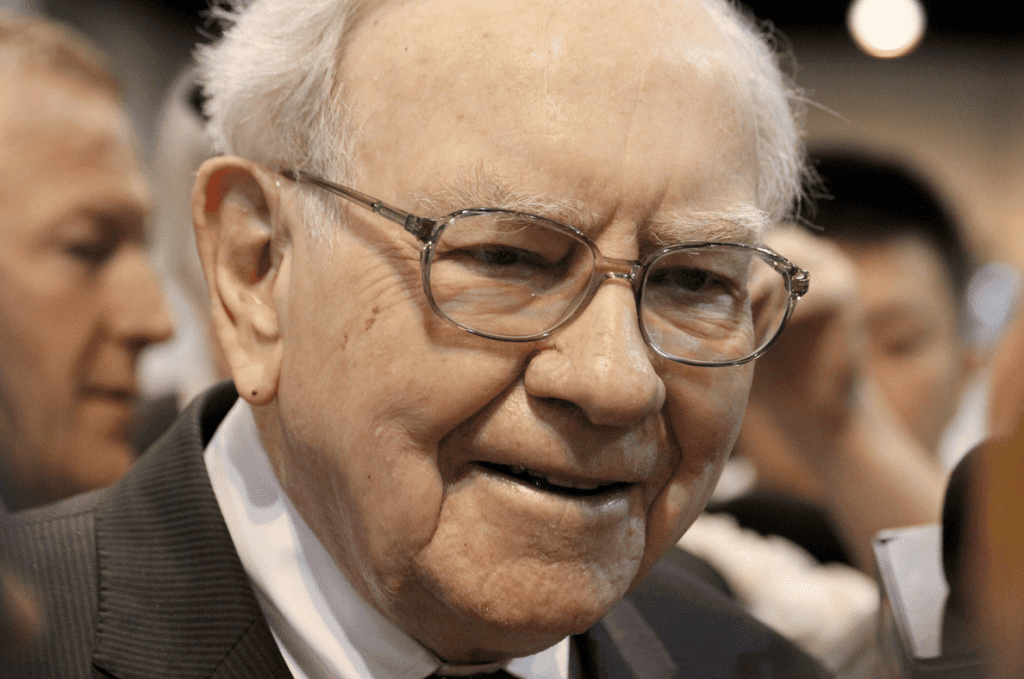

Warren Buffett endorses these three high-quality stocks.

On December 31, 2025, Warren Buffett stepped down as CEO of Berkshire Hathaway, concluding a 60-year tenure during which he transformed the company from a struggling textile mill into one of the largest conglomerates in the world.

Although Buffett is no longer leading the company, Berkshire Hathaway remains steadfast in its approach. His successors continue to follow his proven investment strategies, and the company has not significantly divested from positions formed under his leadership.

If you’re looking to build a long-term, diversified investment portfolio with an initial amount of $2,000, consider incorporating some investments favored by Warren Buffett. Three notable options are Chubb (CB 0.78%), Chevron (CVX +1.84%), and DaVita (DVA 1.72%).

Chubb: A Leader in the Insurance Sector

Since 2023, Berkshire Hathaway has been increasing its stake in Chubb, now holding 8.8% of the company valued approximately at $11.2 billion. While it’s uncertain if these investments indicate a future acquisition, it’s worth noting Berkshire’s history of acquiring numerous insurance firms.

Regardless of the acquisition rumors, Chubb remains an appealing option for investors. The company is expecting “double-digit growth” in earnings per share and tangible book value for 2026, following its robust fiscal performance in 2025. Chubb emphasizes quality underwriting over volume, which bodes well for its financial outlook. Additionally, its commitment to dividend growth is impressive, boasting 32 consecutive years of dividend increases, though it currently yields about 1.2%.

Chevron: Long-Term Growth Drivers

This year, Chevron’s share price has surged by 20%, influenced by geopolitical events. After this increase, shares are now trading at 24 times forward earnings—a valuation typically associated with technology stocks instead of energy companies. Despite appearing expensive currently, the long-term outlook is bright, with Chevron actively pursuing increased production through new contracts in Libya, Syria, and Turkey.

Moreover, Chevron aims to minimize operational costs and is involved in partnerships focused on providing natural gas-generated energy for AI data centers. These factors could lead to considerable earnings growth and sustained stock appreciation over the coming years.

DaVita: Emergence from Multiyear Challenges

Berkshire Hathaway has held shares in DaVita since late 2011. Although the stock has been stagnant, it has recently jumped by 32%, attributed to favorable quarterly results. Management has indicated that international expansion is key to their growth strategy. For 2026, they project adjusted earnings per share between $13.60 and $15, which translates to an increase of 25% to 39% from 2025 figures.

While Berkshire recently sold a portion of its DaVita stock, it still owns a substantial 45.1% stake. This divestment aligns with an agreement to maintain ownership below 45%, driven by DaVita’s active share repurchase strategy.