Asian stocks saw a recovery after experiencing significant losses, with Japan leading the charge amid expectations of favorable treatment in US trade discussions. US Treasuries also gained value following a steep sell-off on Monday.

Japan’s benchmark indices surged over 5%, along with rising futures in the US and European markets. Stocks in Hong Kong and China also rose as state-owned funds increased their acquisitions, and the central bank announced measures to stabilize the financial market. Both oil and gold prices increased, while the dollar weakened against other currencies.

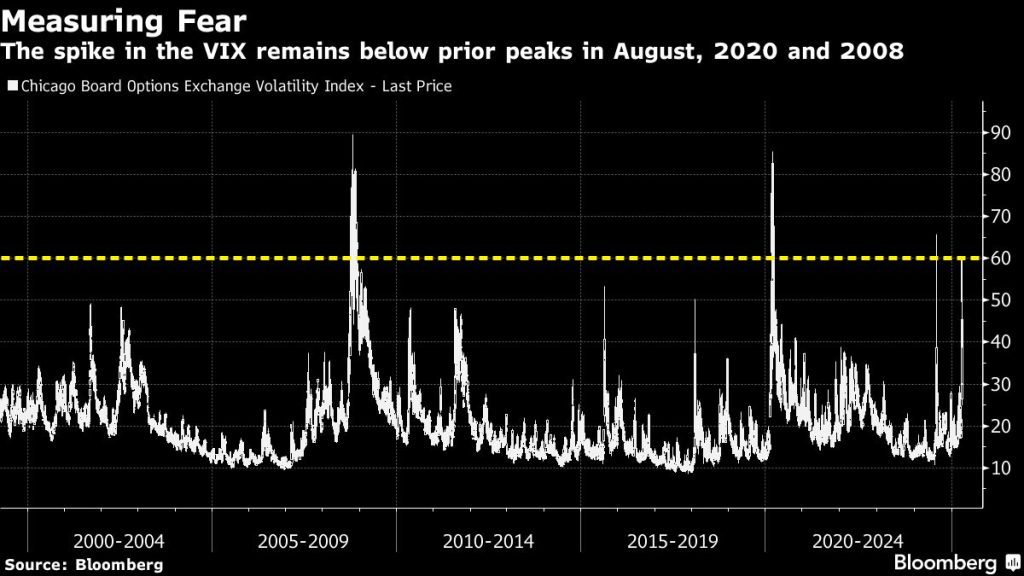

Market volatility has spiked, with $10 trillion lost in global equities after the recent implementation of extensive tariffs by the US. Growing concerns about a potential global recession and an escalating trade war have left investors on edge, looking for any glimmer of good news. President Trump has indicated the possibility of imposing an additional 50% tariff on China while also suggesting negotiations might be in order.

“It’s premature to declare that we’ve reached a turning point, especially with Trump contemplating further tariffs on China,” remarked Tim Waterer, chief market analyst at KCM Trade. “Numerous factors are in play, and recession risks remain a possibility as the US maintains its tough stance on tariffs.”

Japanese stocks surged due to President Trump assigning cabinet members to initiate trade discussions following a phone call with Prime Minister Shigeru Ishiba. Japan seems poised to receive preferential treatment over other trading partners in tariff negotiations, placing it at the forefront among nations seeking tariff reductions.

Despite Trump’s various statements about trade duties, he provided little insight into what he expects in return for lowering tariffs or if he is even willing to offer concessions. “We still lack clarity on the state of these trade negotiations,” said Peter S. Kim, an investment strategist at KB Securities. “The market was stunned by the severity and scope of this trade war and the aggressive tactics employed.”

On Tuesday, China criticized the US threat to further increase tariffs, vowing to retaliate if the US proceeded. The Chinese Ministry of Commerce labeled the tariff threat as a misstep, indicating that China would fight back if the US continued down this path. Meanwhile, state-backed funds in Beijing pledged to support local equities and ETFs amid continuing trade tensions.