Sure! Here’s a paraphrased version of the article in HTML format, maintaining the core information and structure:

<div class="atoms-wrapper">

<h1>The Banking Sector's High-Stakes Game</h1>

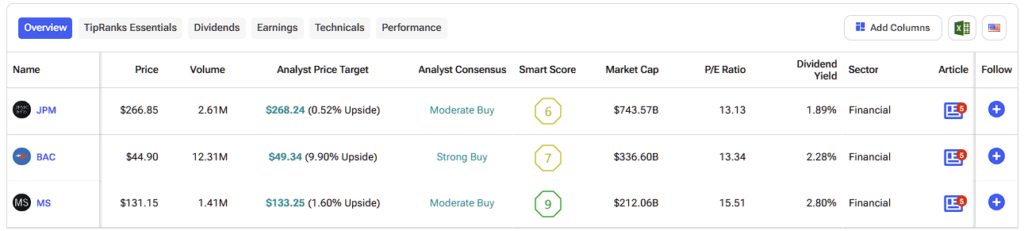

<p>The banking industry resembles a high-stakes poker match, with rapid chip exchanges, heightened tension among players, and the dealer—representing the global economy—shuffling unpredictable cards. As tariffs escalate and markets fluctuate, concerns about a potential <a href="https://www.tipranks.com/economic-indicators?utm_source=finance.yahoo.com&utm_medium=referral" target="_blank" rel="nofollow noopener">recession</a> become more pronounced. Nevertheless, JPMorgan Chase (JPM), Bank of America (BAC), and Morgan Stanley (MS) remain actively engaged, dismissing market jitters with the confidence of experienced players.</p>

<h2>Navigating Economic Challenges</h2>

<p>The three major banks are maneuvering through a complex environment marked by intense trade conflicts, uncertain interest rates, and shifting market conditions. Despite these challenges, their performance exceeds most investor expectations.</p>

<h2>Optimism in the Trump Era</h2>

<p>During the <a href="https://www.tipranks.com/stocks/djt?utm_source=finance.yahoo.com&utm_medium=referral" target="_blank" rel="nofollow noopener">Trump</a> presidency, sentiment around the banking sector is bullish. Anticipation of fewer regulations, reductions in capital stipulations, and the looming influence of cryptocurrency are expected to enhance the profitability of major financial institutions.</p>

<h2>JPMorgan's Resilience</h2>

<p>JPMorgan Chase manages to shine even in adverse conditions. Their <a href="https://www.tipranks.com/stocks/jpm/earnings?utm_source=finance.yahoo.com&utm_medium=referral" target="_blank" rel="nofollow noopener">first quarter</a> displays impressive results, with revenues hitting $46 billion—an 8% year-over-year increase—and a net income of $14.6 billion, boosted by soaring equities trading. CEO Jamie Dimon acknowledges market volatility, influenced by Trump's <a href="https://www.tipranks.com/compare-stocks/stocks-hurt-by-trump-tariffs?utm_source=finance.yahoo.com&utm_medium=referral" target="_blank" rel="nofollow noopener">tariff</a> discussions, which have bolstered trading activities. However, he remains wary of a potential recession, preparing by raising loan loss provisions from $1.9 billion to $3.3 billion.</p>

<h2>Bank of America's Steady Approach</h2>

<p>Bank of America reported a solid first quarter, achieving an <a href="https://www.tipranks.com/stocks/bac/earnings?utm_source=finance.yahoo.com&utm_medium=referral" target="_blank" rel="nofollow noopener">EPS of 90 cents and $27.51 billion</a> in revenue, a 5.9% increase. Their consumer banking segment led with $14.6 billion in net interest income. CEO Brian Moynihan emphasized robust consumer spending and disciplined underwriting practices. However, concerns loom regarding the slowdown in mergers and acquisitions (M&A) impacting their investment banking revenue.</p>

<h2>Prospects for Morgan Stanley</h2>

<p>Morgan Stanley is also reporting solid figures, with <a href="https://www.tipranks.com/stocks/ms/earnings?utm_source=finance.yahoo.com&utm_medium=referral" target="_blank" rel="nofollow noopener">$17.7 billion in revenue and a $2.60 EPS</a> in the first quarter, underscored by a 45% surge in equities trading. Their wealth management division remains robust, though a decline in investment banking revenue from M&A advisory fees poses challenges. CEO Edward Pick highlighted the firm's global partnerships and capital in private credit, crucial for navigating current market volatility.</p>

<h2>Conclusion: Balancing Opportunity and Risk</h2>

<p>Each of these banking giants brings unique strengths alongside inherent risks. The political landscape under Trump, with promises of pro-business policies, may favor these institutions, enhancing their prospects. While JPMorgan thrives under market volatility, it faces interest rate risks; Bank of America maintains a solid consumer base but must contend with M&A slowdowns. Meanwhile, Morgan Stanley pursues global diversification while responding to geopolitical and trade tensions. Although tariffs and inflation may pose ongoing challenges, the potential for a more bank-friendly administration may position these institutions as long-term beneficiaries.</p>

</div>Feel free to customize any part further!