In the late 1990s, the dot-com boom became a prime example of excessive tech enthusiasm. The excitement surrounding the digital economy led to a surge in internet startups, but this bubble eventually burst. Fast forward to today, the rapid growth of AI has raised similar concerns.

However, this surge appears distinct. AI transcends a niche market, profoundly altering various industries with changes that seem set to last for decades rather than fleeting years.

Statistics support this notion of longevity. The Chief Investment Office at UBS estimates that AI could potentially yield up to $1.5 trillion in annual revenues. Although the sector is still progressing toward that target, it seems attainable. While significant capital investments – totaling around $780 billion since 2022 – may seem intimidating, they are justified in light of projected future gains.

UBS recently summarized its view, stating, “We remain hopeful about AI’s continuing potential to exceed expectations. This trend emphasizes the importance of long-term investments, and we advocate for a balanced approach across technology sectors… While acknowledging the risk of ‘capex indigestion’ following years of substantial spending by major tech firms, we believe AI exposure will be crucial for portfolio growth over the medium and long terms.”

UBS is backing its confidence with action, identifying two AI-oriented stocks that it believes are particularly advantageous at this time. Both are also rated as Buys according to the TipRanks database.

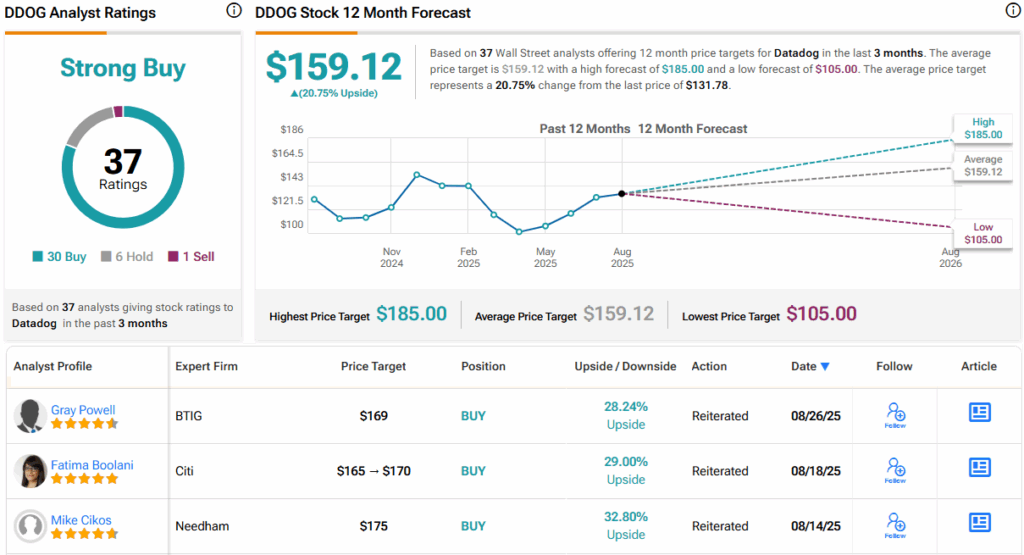

Datadog, Inc. (DDOG)

First up is Datadog, a New York City-based tech firm focused on real-time data analytics since 2010. Its Bits AI offers a variety of AI-driven tools and applications for developing, monitoring, and securing data workflows. The system autonomously investigates alerts, suggests code improvements, and assesses security measures, enabling users to efficiently address data issues at any scale.

Cognex (CGNX)

Next on UBS’s radar is Cognex, recognized as a leader in machine vision systems. Founded in 1981, Cognex has evolved its product range to play a critical role in manufacturing, particularly within the semiconductor industry. The rise of AI has opened new avenues for the company, as its technology now supports various sectors, including high-tech chip manufacturing and logistics.

In conclusion, while the landscape of AI is changing, stocks like Datadog and Cognex showcase the potential for sustained growth backed by solid fundamentals and innovative products.