Stock prices are declining as news outlets announce “Markets in Turmoil!” Amidst growing uncertainty regarding the effects of President Trump’s tariffs on the U.S. economy, both the Nasdaq Composite and the tech-heavy Nasdaq-100 have dropped over 12% from their zeniths in January. This trend has led investors to withdraw funds from more volatile growth stocks, intensifying apprehensions in the market.

However, not all stocks are experiencing downturns. During volatile periods, investors often seek refuge in stable, low-risk dividend-paying stocks like Altria Group (NYSE: MO). This tobacco and nicotine leader has appreciated nearly 10% this year and offers a dividend yield of 7%. With this backdrop, is now the right time to invest $1,000 in Altria stock?

Altria owns Philip Morris USA, which markets a variety of cigarette brands, including the dominant Marlboro. Despite cigarettes remaining popular, U.S. sales have been on a downward trajectory for decades, continuing into the present. In its latest quarter, Altria reported an 8% year-over-year decline in cigarette sales volume.

Nevertheless, Altria’s net revenue, post-excise taxes, increased by 1.6% year-over-year, reaching $5.1 billion last quarter. This growth was facilitated by a notable price hike on cigarette packages, compensating for reduced sales. Altria’s ability to leverage pricing has allowed it to sustain revenue growth and bolster profit margins in its smokeable segment. In 2024, operating income from smokeables rose by 1.4% to $10.8 billion, which constitutes the majority of the company’s profits, boasting an impressive 60% operating margin.

Looking long-term, Altria aims to substantially expand its smoke-free product line, which includes nicotine pouches and vaping options, with aspirations of doubling smoke-free sales to $5 billion by 2028. This would represent a significant contribution to Altria’s current annual revenue of $20 billion. However, the company lags behind competitors like Philip Morris International, where smoke-free offerings are nearing 50% of total sales. This evolving segment is critical to watch in the coming years.

Altria’s core business remains lucrative, but it operates within a low-growth market. The potential of its smoke-free products is still developing, and the company’s capital return strategy might be its standout feature for investors.

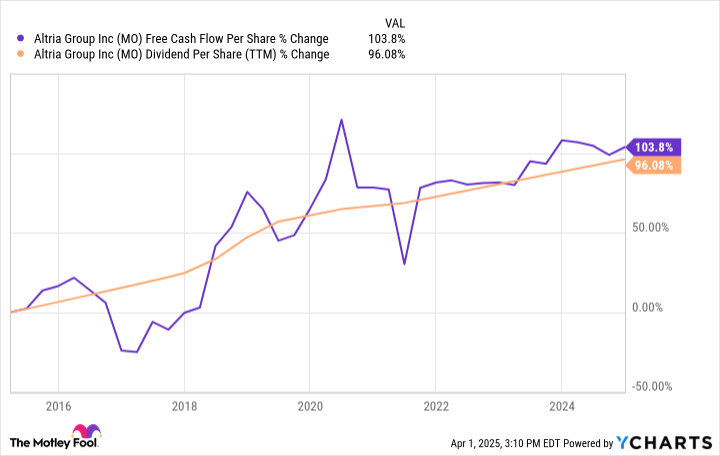

Altria Group consistently enhances its per-share payouts through a mix of share buybacks and dividend increases. Over the past decade, the number of outstanding shares has dropped by 14%, with buybacks accelerating in 2024, leading to a 100% rise in the dividend per share. Currently, the quarterly dividend stands at $1.02. Management plans to increase dividends annually at a mid-single-digit percentage rate (approximately 5%) through 2028. Given the continuous share repurchases and robust cash flow from its cigarette operations, this goal appears achievable.