Marshall Islands Launches Innovative Universal Basic Income Scheme

The Marshall Islands has initiated a groundbreaking national universal basic income (UBI) program that includes payments through cryptocurrency alongside traditional methods. Experts note this initiative is unprecedented globally.

Quarterly Payments for Residents

As part of the initiative, every citizen of the Marshall Islands will receive approximately US$200 every quarter aimed at alleviating cost of living challenges. The inaugural payments were disbursed in late November, allowing recipients to select their preferred payment method: bank transfer, cheque, or via cryptocurrency through a government-supported digital wallet.

A Commitment to Inclusivity

Marshall Islands’ Minister of Finance, David Paul, expressed that the government aims to ensure no citizen is overlooked: “We want to make sure no one is left behind,” he stated. He noted the $200 quarterly payment could serve as a morale booster rather than a financial necessity to leave employment.

Financial Support Amid Rising Costs

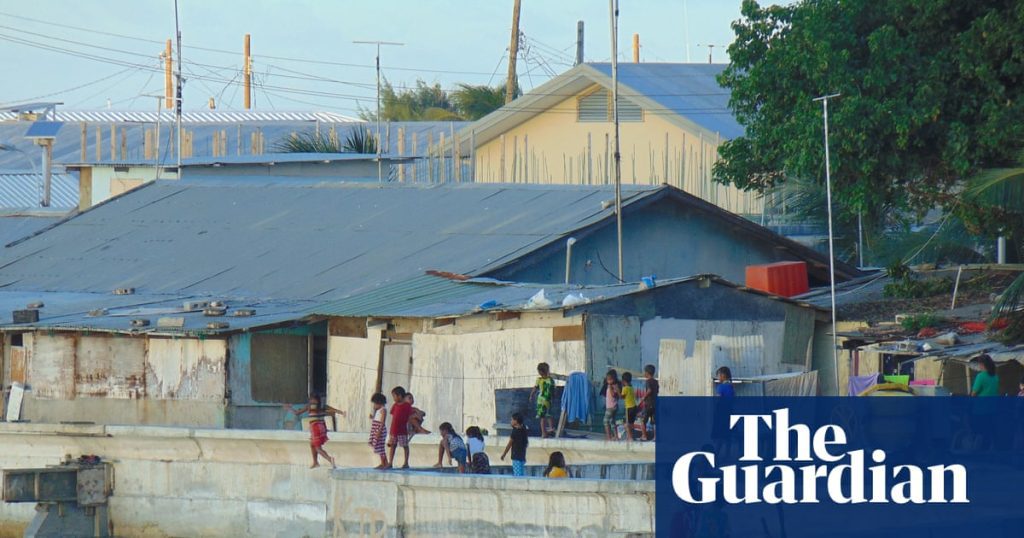

Situated in the Pacific Ocean with a population of around 42,000, the Marshall Islands is grappling with escalating living costs and emigration. Paul indicated the payments serve as a “social safety net” in these challenging times.

Financing the UBI Program

The UBI initiative is funded by a trust established under an agreement with the United States, aimed partly at compensating the Marshall Islands for years of nuclear testing. This fund currently holds over $1.3 billion in assets, with an additional $500 million pledged by the US up to 2027.

Blockchain Utilization and Challenges

Dr. Huy Pham, an expert in crypto-fintech, stated that the Marshall Islands’ scheme represents a world-first for nationwide UBI deployment, highlighting the unique application of blockchain technology. This cryptocurrency option, which uses a stablecoin tied to the US dollar, addresses logistical issues in distributing funds across numerous remote islands.

Utilization of Funds and Future Outlook

While many recipients prefer traditional payment methods—about 60% opted for bank deposits—some are using the funds for essentials or celebrations. Previous attempts by the Marshall Islands to implement cryptocurrency, such as the Sovereign (SOV), faced challenges, showcasing potential risks outlined by the IMF regarding financial integrity and governance. Analysts believe that although predicting success is difficult, digital wallets may improve financial accessibility for geographically dispersed communities.