The cryptocurrency market is picking up steam as the price of Bitcoin (BTC) approaches $107,000. Major altcoins like Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) are also experiencing consistent recovery following recent downturns. Increasing optimism in the market is bolstered by renewed interest from institutions and enhanced on-chain activity.

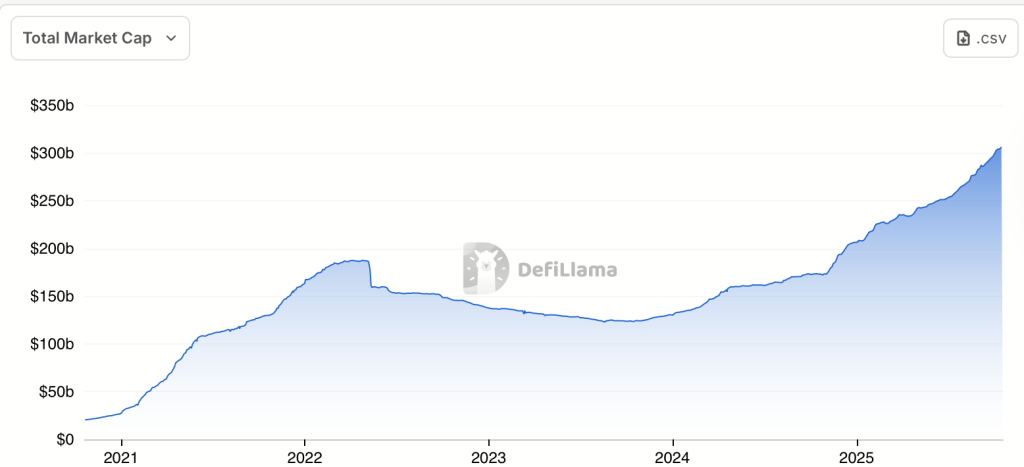

Stablecoin Supply Reaches Record $304.5 Billion

The supply of stablecoins has surged to an unprecedented level of $304.5 billion, indicating a substantial accumulation of liquidity within the cryptocurrency ecosystem. This significant stockpile of dormant capital reflects growing investor confidence and a willingness to reinvest in lucrative cryptocurrency ventures. Stablecoins, tied to the U.S. dollar, remain essential to the crypto economy, providing stability, effortless transfers, and access to decentralized markets.

An increasing stablecoin market cap often precedes significant market shifts, indicating that investors are accumulating potential capital to reinvest in Bitcoin (BTC), Ethereum (ETH), and various altcoins. Analysts note that such substantial reserves typically create bullish momentum across the entire digital asset landscape once reinvested into higher-risk assets or yield-generating protocols.

DeFi and Tokenization: Future Growth Areas

Experts suggest that the next notable wave of liquidity may direct itself toward Decentralized Finance (DeFi) and tokenized real-world assets (RWAs).

- DeFi Expansion: Lending platforms, decentralized exchanges, and yield farms increasingly attract stablecoin investments searching for profitable yield opportunities. Enhanced security and institutional-grade protocols continue to legitimize DeFi as a primary financial infrastructure.

- Surge in Tokenization: Assets like bonds, treasuries, and real estate are being integrated into blockchain. Major financial players, such as BlackRock and Standard Chartered, are already exploring the use of stablecoins for blockchain-based settlements.

A Positive Indication for Bitcoin and DeFi

A variety of catalysts could spark this significant liquidity reserve—these include regulatory clarity, increased institutional participation, and macroeconomic changes that drive capital into the crypto space. A favorable policy change or the integration of stablecoin payments by a major financial entity could initiate the next liquidity supercycle in crypto.

The astounding figure of $304.5 billion in stablecoins isn’t merely idle cash; rather, it’s a catalyst for a forthcoming major expansion in crypto. With the acceleration of DeFi, RWAs, and blockchain utilization, this liquidity could soon re-enter the market, potentially elevating Bitcoin, Ethereum, and DeFi tokens to new record levels.

Trust with CoinPedia:

Since 2017, CoinPedia has provided precise and timely updates on cryptocurrency and blockchain. All content is generated by our expert analysts and journalists, adhering to rigorous Editorial Guidelines grounded in E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Each article is validated with reputable sources to ensure accuracy, transparency, and trust. Our review policy guarantees impartial evaluations when recommending exchanges, platforms, or tools. We strive for timely reports on all things crypto & blockchain, from startups to industry leaders.

Investment Disclaimer:

All insights and opinions expressed represent the author’s views on market conditions at the time. Always conduct your own research before making investment decisions. Neither the writer nor the publication bears responsibility for your financial choices.

Sponsored Content and Advertisements:

Sponsored articles and affiliate links may appear on our platform. Advertisements are clearly marked, while our editorial content remains entirely independent from our advertising partners.