From pipelines to power plants, these three energy stocks are designed to provide long-term returns.

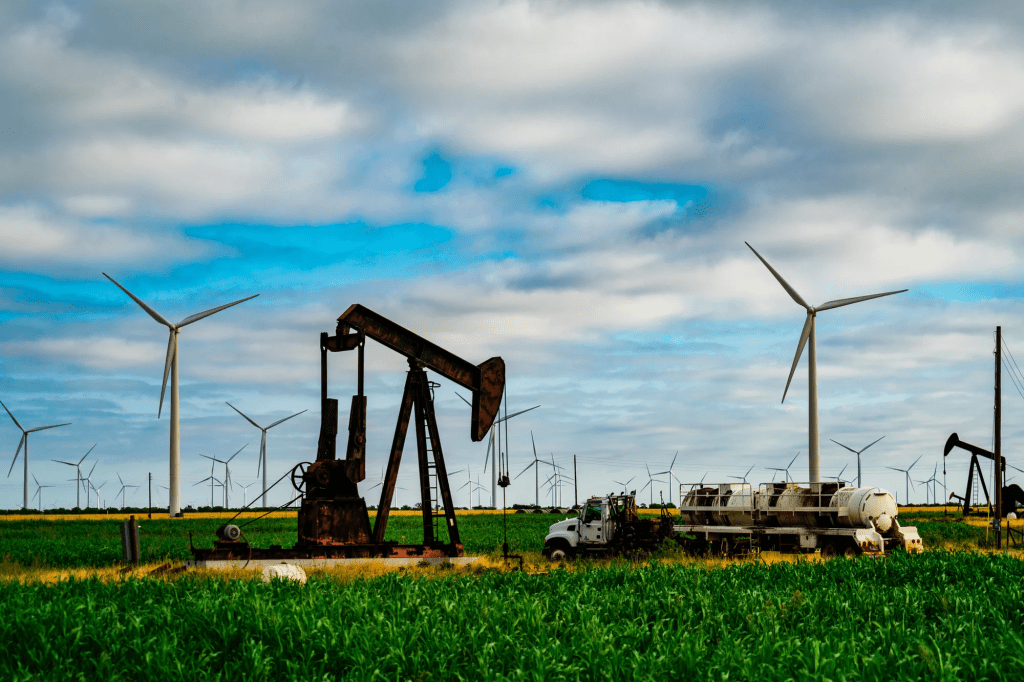

Traditional energy sources are here to stay. As the world shifts towards cleaner energy, oil and gas—and their supporting infrastructure—remain crucial to the global economy.

With increasing electricity needs driven by AI and data centers, there’s ample opportunity for both established energy giants and emerging renewable companies to succeed.

If you have $500 to invest and want to create a diversified energy portfolio for the long run, the main objective is clear: Seek out firms with solid financials, reliable dividends, and a presence in both traditional and renewable energy sectors. The three energy stocks detailed below meet these criteria perfectly.

1. ExxonMobil: Traditional Energy with Modern Ambitions

ExxonMobil (XOM -1.96%) is a leader in classical energy. It operates across oil fields, gas stations, and refineries, positioning itself to withstand various market fluctuations.

While primarily a fossil fuel company, Exxon is not lagging behind. In December 2024, it announced a bold initiative aimed at generating $20 billion in new earnings by 2030, along with $30 billion in added cash flow, all while investing $140 billion into significant projects and increasing shareholder returns.

2. Enbridge: A Dividend Powerhouse Investing in Renewables

Enbridge (ENB 2.01%) serves as a crucial energy conduit in Canada, transporting around 30% of North America’s crude oil and 20% of the U.S. natural gas supply. Its extensive pipeline network spans over 18,000 miles.

With a dividend yield exceeding 6% and three decades of consistent increases, Enbridge appeals to income-focused investors. Additionally, it is diversifying by investing in offshore wind, solar, and renewable natural gas, underscoring its dual growth strategy.

3. NextEra Energy: Leader in Clean Energy

NextEra Energy (NEE -0.84%), the sole renewables stock in this review, offers long-term growth devoid of fossil fuel liabilities. It stands as the largest producer of wind and solar energy globally and manages Florida Power & Light, the biggest regulated utility in the U.S.

In the second quarter, NextEra added 3.2 gigawatts of new clean energy projects, expanding its total backlog to 30 gigawatts. This robust pipeline positions the company for projected annual earnings growth of 6% to 8% through 2027.

Investing in Energy for the Future

With ExxonMobil’s legacy in oil, Enbridge’s extensive pipeline operations, and NextEra’s innovative clean energy initiatives, investors have a range of solid options. Each firm contributes uniquely to the energy landscape, making them resilient investments. Whether you seek dividends or stability, these three companies provide a well-rounded approach to investing in the future of energy.