As the race for advancements in artificial intelligence (AI) continues, the competition in quantum computing is intensifying. While various companies are competing for a leading position in this sector, not all are wise investment choices at this moment.

Among the top contenders for quantum computing investments are Nvidia (NVDA -0.64%), Alphabet (GOOG 2.74%) (GOOGL 2.73%), and IonQ (IONQ -4.29%). A mix of these three stocks is a solid strategy for investors to mitigate risks while capitalizing on the potential of this innovative technology.

Nvidia

Nvidia may appear to be an unusual candidate for this list, as it isn’t directly involved in quantum computing. Instead, it focuses on creating tools that help competitors integrate quantum processing units (QPUs) into high-performance computing systems. Notably, Nvidia has developed CUDA-Q, a version of its CUDA software designed for quantum applications.

The CUDA platform has been fundamental in establishing Nvidia as the leader in the GPU market, allowing it to grow into the largest company globally. By adapting this software for quantum use, Nvidia secures its position as a vital partner in quantum advancements. This integration helps protect its existing operations from being overshadowed by new competitors.

Alphabet

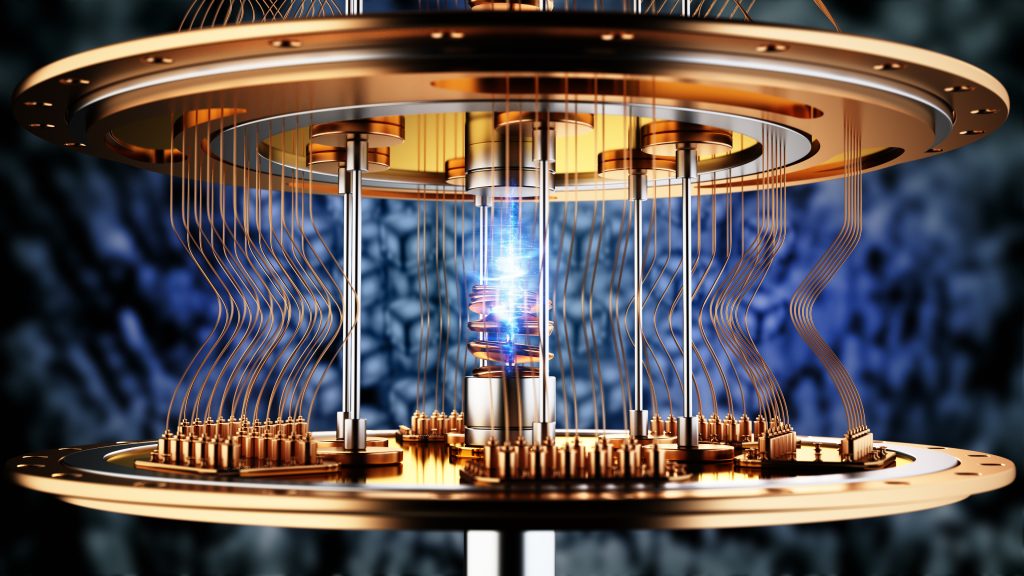

Alphabet, the parent company of Google, plays a pivotal role in generating investor enthusiasm for quantum computing. In December, it revealed that its Willow chip performed a task in five minutes with remarkable accuracy—something that would take the most powerful supercomputer 10 septillion years to accomplish.

While Google acknowledges that this specific task is tailored for quantum computing and holds no immediate commercial value, it highlights the rapid progress of quantum technology toward practical applications. Alphabet is among my top choices in this field due to its substantial resources devoted to quantum computing.

IonQ

IonQ stands out as a smaller, pure-play company solely focused on quantum computing, meaning its success is tied directly to this market. For IonQ to gain traction, it must possess technology that sets it apart from the competition.

Unlike most competitors that utilize a superconducting technique requiring extreme cooling—an expensive endeavor—IonQ employs a trapped ion method. This allows quantum computing to occur at room temperature, significantly lowering operational costs. Additionally, this method enables every qubit to interact with one another, enhancing calculation accuracy compared to superconducting qubits that can only interact with their direct neighbors. This innovative approach positions IonQ as a leading contender in the quantum computing arena, making it a promising pick for investors looking for high-risk, high-reward opportunities.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet and Nvidia, and The Motley Fool recommends both companies. The Motley Fool has a disclosure policy.