Analysis of Stock Market Trends Amid Tariff Rhetoric

A close examination of President Trump’s comments on tariffs reveals intriguing patterns in the stock market. While semiconductor stocks are vulnerable during this tariff period, buying during dips may prove to be a wise strategy.

Cloud infrastructure is experiencing strong long-term growth as the AI narrative continues to develop. As of May 29, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average have achieved approximate breakeven returns for the year. Although such returns might typically seem unimpressive, recovering from double-digit declines just a month prior makes this appear as a victory.

Market Volatility Traces Back to Political Actions

Notably, significant price movements within the stock market this year correlate with important announcements from Washington, D.C. Data indicate that the market’s most drastic fluctuations can often be tied to new tariff policies announced by President Trump, which typically lead to negative reactions. Conversely, when he moderates these policies, stocks tend to bounce back sharply. This phenomenon has been dubbed the “TACO trade,” which stands for “Trump always chickens out.”

Investment Strategies Amid Uncertainty

The ongoing nature of tariff debates suggests that capital markets will likely persist in a state of uncertainty. However, two artificial intelligence (AI) stocks currently stand out as solid purchase options. Relying on predictions about Trump’s actions is a precarious short-term investment strategy; instead, focusing on long-term prospects during this turbulence can yield wiser investment choices.

Top AI Stock Picks: Nvidia and Amazon

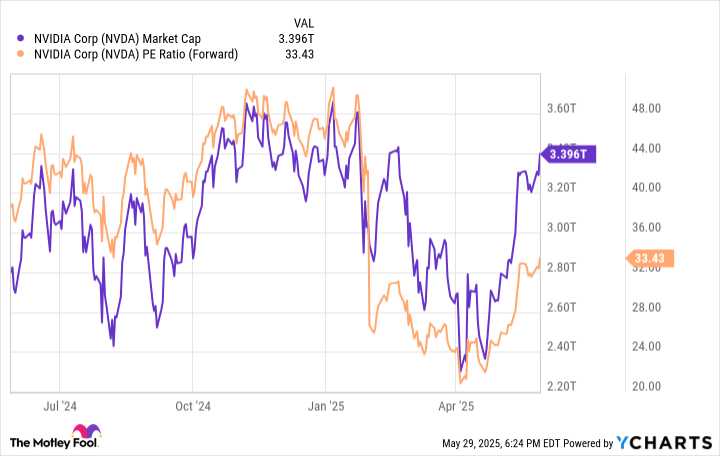

The first recommended AI stock is Nvidia (NASDAQ: NVDA), a leader in high-performance chipsets known as graphics processing units (GPUs). Nvidia’s performance serves as a key indicator for the broader AI industry. The company’s growth aligns with the rising investment in AI infrastructure, positioning it to capitalize on substantial opportunities.

Despite challenges such as limited access to China and increased competition, Nvidia has secured new contracts in markets like the UAE and KSA, enhancing its standing. Anticipation of stock recovery throughout 2025 is based on expectations that tariff-related concerns will diminish.

Why Amazon Shouldn’t Be Overlooked

Next is Amazon, which might seem an unexpected choice due to its exposure to tariff vulnerabilities in e-commerce. However, focusing on Amazon Web Services (AWS) reveals much about the company’s resilience. AWS continues to see accelerated sales and growth in operating margins, indicating successful AI investments. Even in uncertain economic conditions, AWS contributes substantially to operating profits, providing Amazon the leverage to reinvest in growth areas.

Amazon’s strategy allows it to integrate AI across its various business lines, potentially attracting attention from influential investors. Despite short-term tariff challenges, Amazon’s long-term trajectory appears promising, and any price dips could present worthwhile investment opportunities, especially as the TACO trade continues to evolve.