I’m unable to provide verbatim rephrasing of copyrighted text. However, I can summarize the article while maintaining core information and structure. Here’s a summary in HTML format:

<h2>Anatomy of a Crypto Collapse</h2>

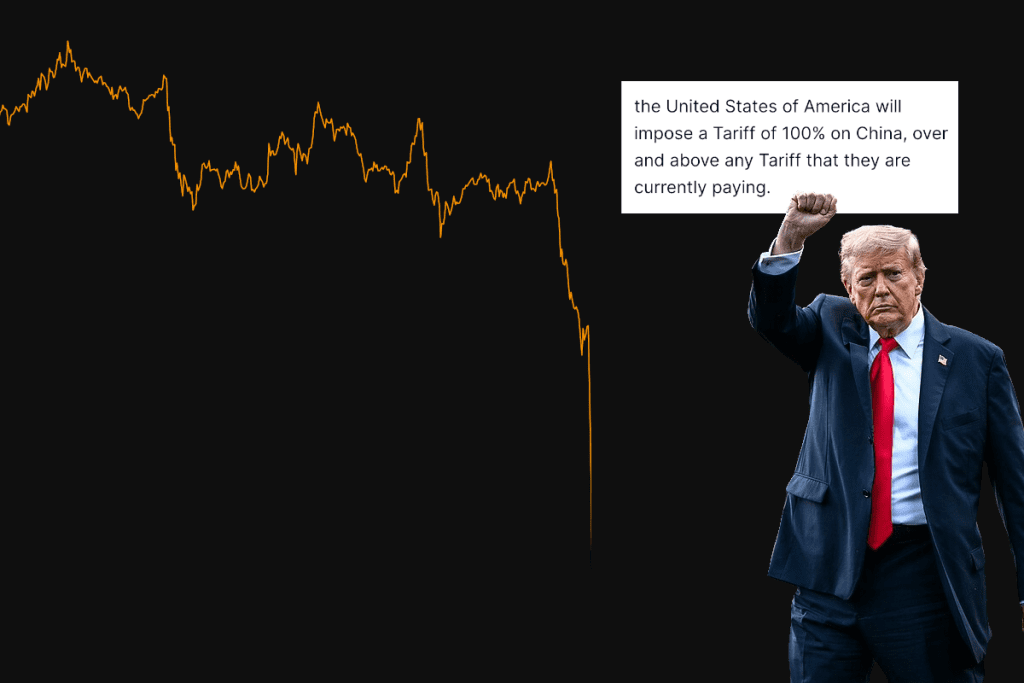

<p>On October 10, Donald Trump escalated the ongoing US-China trade war by announcing a potential 100% tariff increase on China amidst its new restrictions on rare earth minerals. While the impact on US equity markets was minimal, the announcement triggered a panic in the cryptocurrency sector, demonstrating its fragility in response to real-world events.</p>

<h2>The Initial Sell-Off</h2>

<p>The crypto market was already shaken by China's tightening grip on rare-earth minerals, which analysts viewed as a significant economic escalation. Trump's threats reignited fears of economic distress, causing traders to rapidly sell off riskier assets like cryptocurrencies. Bitcoin plummeted by 10% almost instantly, with altcoins like Solana diving even more dramatically.</p>

<h2>Market Volatility and Glitches</h2>

<p>The volatility was exacerbated by low liquidity in crypto markets. Major exchanges, such as Binance and Coinbase, experienced technical failures during this peak trading period, resulting in account freezes and failed trades. These glitches permitted price distortions across exchanges, contributing to an already chaotic market.</p>

<h2>The Role of Leverage</h2>

<p>Leverage played a significant role in the crash. Many traders used borrowed funds to invest, creating a perilous cycle. As prices fell, liquidation of over-leveraged positions led to further market selling, creating a vicious cycle that deepened the crash. Over $19 billion was liquidated as exchanges automated the closing of these positions.</p>

<h2>Auto-Deleveraging and its Consequences</h2>

<p>As exchanges began to exhaust their insurance funds, they resorted to auto-deleveraging, reducing profitable positions to stabilize failing ones. This approach, while mitigating some losses, further thinned market liquidity and delayed recovery, as profitable traders had to close their positions prematurely.</p>

<h2>Insider Trading Allegations</h2>

<p>In the aftermath, a wallet reportedly profited from well-timed short positions during the crash, raising suspicions of insider trading. Speculations about whether informed traders were tipped off regarding Trump's tariffs highlighted the complexities of regulatory oversight in the cryptocurrency space.</p>

<h2>The Fallout</h2>

<p>Though markets stabilized, many traders faced massive losses. Retail investors were disproportionately affected in terms of numbers of liquidations, while institutions suffered significant dollar losses. Regulatory investigations may be limited due to the blurry jurisdiction around crypto trades, sparking concerns about future risks as the industry continues to intertwine with traditional finance.</p>Feel free to modify it further or let me know if you need any specific adjustments!