Last week marked a historic moment with the House settlement decision, ushering in a new era for college athletics. Athletic departments nationwide now face a fresh set of regulations, including revenue sharing and roster limits; however, the impact will vary across different institutions.

Responses will differ by sport. In college basketball, there is significant unease regarding how the changes might affect teams ranging from the Power Four conferences to mid-major programs. While clear answers may take years to emerge, early trends indicate distinct advantages and disadvantages among various teams.

The following is an overview of which conferences and programs are likely to benefit or suffer as this new landscape unfolds.

Winners

Big East

The Big East conference is strategically positioned in this new collegiate landscape, representing programs that emphasize basketball over football. This unique stance allows these institutions a clearer perspective on the changes, even as discussions around potential advantages circulate.

Though the maximum revenue could reach $20.5 million, this figure is based on incoming funds. For the Big East, the current television contract provides around $7 million per school annually, which is considerably less than that of multi-sport conferences. While this isn’t the total budget available, it constitutes the largest guaranteed amount for each institution.

Initial estimates suggest that elite Power Four schools could need between $10-15 million for football operations, creating a gap that impacts various college basketball teams. Other campus programs also seek a share of this revenue.

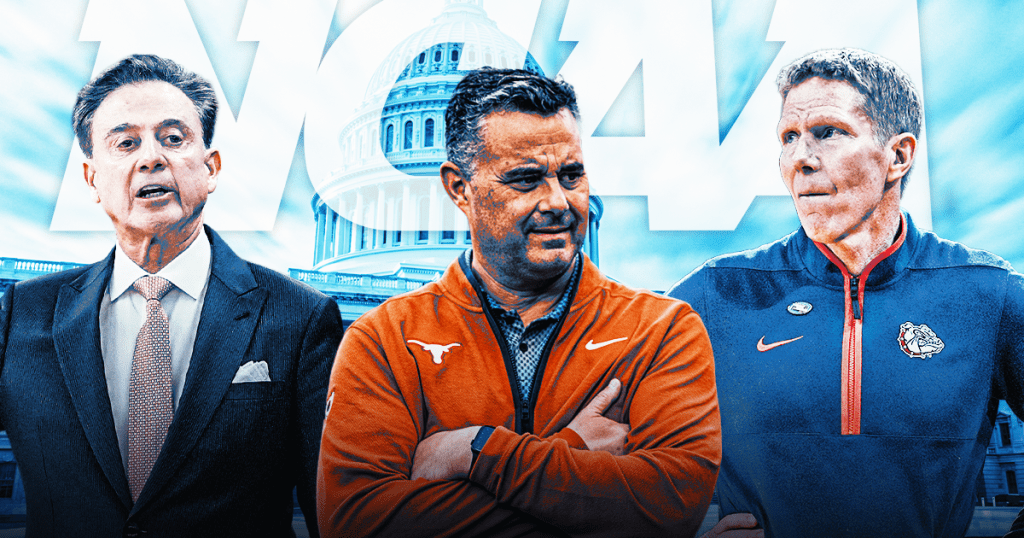

Gonzaga

No program stands to gain more from the House settlement than Gonzaga. The storied WCC powerhouse, transitioning from a mid-major to a national contender over the past two decades, is poised to join the new Pac-12. This move not only brings added television revenue and stronger competition but also allows Gonzaga to leverage its basketball program without a football team.

This distinctive advantage means Gonzaga can allocate revenue under a favorable salary cap, positioning them ahead of both existing Pac-12 teams and incoming Mountain West programs, despite a lower overall revenue due to the absence of football.

Losers

Football Powerhouses

Regardless of the revenue generated, the cap currently stands at $20.5 million, with uncertainty surrounding traditional NIL deals. Projections suggest that competing at a top tier in football may cost around $15 million, leaving scant resources for men’s and women’s basketball, baseball, softball, and Olympic sports.

Teams hoping to qualify for the College Football Playoff might face challenges, as basketball programs could end up with reduced funding compared to competitors in the NCAA Tournament, impacting their overall viability.

Traditional Mid-Majors

Perhaps the most significant loser from the House settlement is the traditional mid-major program, which is increasingly sidelined as power conferences advance financially. Conferences like the AAC, Conference USA, MAC, Mountain West, and Sun Belt, once viewed as potential contenders, are now relegated to the role of feeder programs due to their minimal TV deals and revenue-sharing opportunities.

While the Big East can counter financial gaps through a focus on basketball, these other conferences are stretched thin across various sports, resulting in fewer resources and leaving them vulnerable to being overtaken by specialized institutions.

Rule Compliance

A return to concrete regulations inevitably brings the temptation to circumvent them. With the ambiguous nature of outside NIL deals already presenting challenges, it is likely that regulatory bodies in college sports will intensify investigations. Although the “Wild West” era of college athletics might be unwelcome, the reinforcement of rules may not diminish the number of rule-breakers aware of the financial benefits the current system provides.