2026 is shaping up to be another promising year for the market.

If you have $1,000 available to invest, this moment is ideal for deploying that capital. Research shows that investing sooner rather than later yields better results. The market typically trends upward more frequently than it declines, so even if the market appears slightly overvalued, the risks of missing out on potential gains outweigh the minor losses you could incur by investing now.

Here’s a selection of stocks that seem like strong buys at this time. Each of these stocks is poised for significant success in 2026, and investing now offers the best chance to benefit from their anticipated growth this year.

Image source: Getty Images.

Broadcom

Broadcom (AVGO 2.09%) has become a prominent player in the artificial intelligence sector, owing to its custom AI accelerators. It is collaborating with several AI giants to create tailored chips, including leaders in generative AI like Alphabet (GOOG +0.25%) and OpenAI, the creators of ChatGPT. While Nvidia continues to lead, viable alternatives are emerging.

Today’s Change

(-2.09%) $-7.27

Current Price

$340.35

Key Data Points

Market Cap

$1.6T

Day’s Range

$336.50 – $355.02

52wk Range

$138.10 – $414.61

Volume

821K

Avg Vol

28M

Gross Margin

64.71%

Dividend Yield

0.70%

Broadcom’s growth in AI is expected to yield substantial returns in the upcoming years, with a projected revenue increase of 50% in fiscal year 2026. In FY 2027, growth is anticipated to be 36%, compared to a 24% growth in FY 2025. This rapid acceleration in growth presents a compelling reason to invest in Broadcom now, as it appears well-set to succeed in 2026 and beyond.

Alphabet

Alphabet has transformed from an underdog in the AI race to a strong competitor. Its Gemini project has emerged as a leading generative AI model, demonstrating a remarkable turnaround. Alongside this, Alphabet’s existing businesses are generating impressive results.

Today’s Change

(0.17%) $0.54

Current Price

$315.69

Key Data Points

Market Cap

$3.8T

Day’s Range

$314.89 – $319.01

52wk Range

$140.53 – $328.83

Volume

501K

Avg Vol

36M

Gross Margin

59.18%

Dividend Yield

0.26%

Google Search achieved robust 15% year-over-year growth in the third quarter, surpassing expectations for a unit thought to be vulnerable to disruption by generative AI. Google Cloud also performed well, posting a 33% revenue growth in Q3 and increasing its operating margin from 17% last year to 24% this year.

Alphabet’s momentum is strong, and I expect this to continue into 2026.

Amazon

Amazon (AMZN +3.02%) is also performing well. Its core commerce division is thriving, with online sales up 10% and third-party seller services increasing by 12%. These figures represent recent performance highs, highlighting Amazon’s effectiveness at expanding its market share.

Additionally, Amazon Web Services (AWS) and its advertising services divisions both posted impressive Q3 results, with revenue growth of 20% and 24% respectively—marking the best quarters for these segments in quite some time.

Despite these strong results, Amazon’s stock has not performed similarly, only rising about 6% in 2025, which is below the market average.

Today’s Change

(3.02%) $6.85

Current Price

$233.35

Key Data Points

Market Cap

$2.4T

Day’s Range

$227.19 – $233.83

52wk Range

$161.38 – $258.60

Volume

1.2M

Avg Vol

45M

Gross Margin

50.05%

When a stock lags behind while its business thrives, it often indicates a potential rebound. I believe Amazon will deliver strong results in 2026, and its stock should reflect that recovery.

MercadoLibre

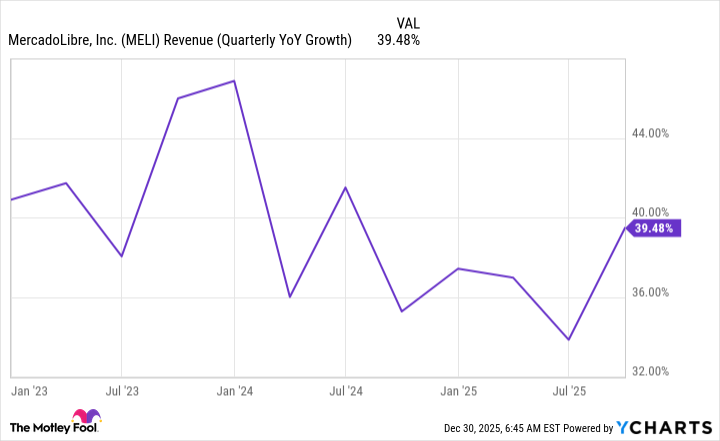

MercadoLibre (MELI +11.21%) stands as one of the most successful companies relatively unknown to many. It has emulated Amazon’s business model in Latin America and expanded by introducing a fintech arm to enhance payments in a region where online payment methods are often limited. This approach has resulted in remarkable, consistent growth for MercadoLibre.

MELI Revenue (Quarterly YoY Growth) data by YCharts.

I foresee no obstacles to MercadoLibre’s growth in 2026, and with its stock down roughly 25% from its peak, this might be the perfect opportunity to buy shares.